Amazon, the name synonymous with online shopping, boasts a remarkable story etched in its Amazon stock price. From its humble beginnings in 1997 at a mere $4 per share, it has transformed into a tech giant valued at over $1 trillion. But the journey hasn't been without its bumps and detours. This article delves into Amazon's past, unveils expert predictions for its future, and explores the key factors that could influence its Amazon stock price in the years to come.

A Blast from the Past: From Humble Beginnings to E-commerce Dominance

Amazon's tale began in 1997, venturing into the uncharted territory of e-commerce. Its initial journey was marked by rapid growth as it expanded its online store and embraced new product categories. However, the dot-com bubble burst in 2000, sending shockwaves through the tech industry and dragging the Amazon stock price down to below $5. Yet, the company displayed remarkable resilience, weathering the storm and emerging stronger.

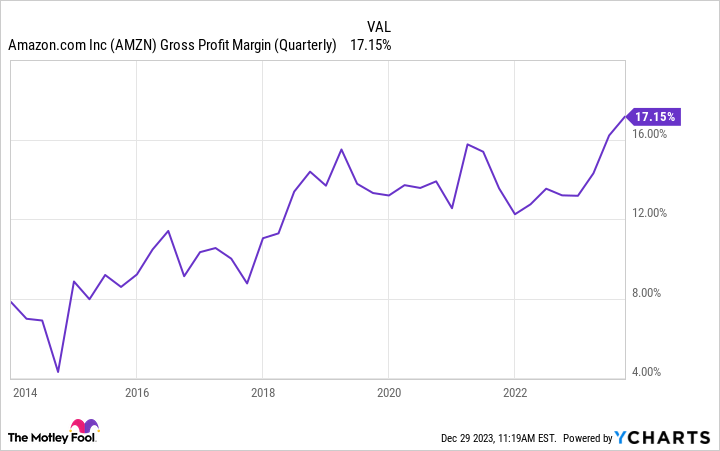

The years that followed (2002-2010) witnessed Amazon's remarkable recovery and reinvention. It shifted its focus towards profitability and operational efficiency, coupled with continuous expansion into diverse product categories. This strategic shift, along with the launch of its secret weapon, Amazon Web Services (AWS) in 2006, propelled its Amazon stock price upwards. Initially considered a fringe project, AWS has evolved into a revenue juggernaut, fueling the company's growth and propelling its stock price to new heights.

Not content with domestic dominance, Amazon set its sights on the global stage, solidifying its position as the undisputed leader in the e-commerce world. Its acquisition of Whole Foods in 2017 marked its foray into the physical retail space, showcasing its relentless pursuit of innovation and expansion. However, the road wasn't always smooth. Amazon faced increased regulatory scrutiny over its market dominance and labor practices. Nonetheless, it adapted to these headwinds, addressing concerns and venturing into exciting new territories like artificial intelligence and healthcare.

Gazing into the Crystal Ball: Short-Term and Long-Term Forecasts for the Amazon Stock Price

Predicting the future of any stock, especially one as dynamic as Amazon's, is no easy feat. However, analyzing expert forecasts can offer valuable insights regarding the future of the Amazon stock price.

Short-term Outlook (Next 12 Months): Based on estimates from analysts, the average predicted share price for Amazon within the next year is $184.23, representing a potential 20.29% increase from the current Amazon stock price. However, predictions vary, with estimates ranging from $145.00 to around $220.00. Key factors like upcoming earnings reports, macroeconomic conditions, holiday season performance, and competitor actions will significantly influence the short-term Amazon stock price.

Long-term Outlook (Next 5+ years): Many analysts hold an optimistic long-term view for the Amazon stock price. Some predict a price target of $252.71 in five years, signifying a potential increase of over 60%. Continued growth in e-commerce, the sustained success of AWS, and potential expansion into new markets like healthcare are seen as key drivers of long-term growth for the Amazon stock price. However, challenges like increased competition, regulatory hurdles, and potential disruptions in the tech sector could pose obstacles to Amazon's long-term trajectory.

Important to note: Stock splits do not alter the total value of your holdings. Your overall ownership percentage remains unchanged, despite alterations in the number of shares and the price per share.

Amazon's decision to undergo stock splits was motivated by various factors, each exerting a distinct influence on the company.

Stock Splits: Making the Shareholder Pie Bigger and Boosting Amazon Stock Price

Throughout its history, Amazon has undergone four stock splits. These splits essentially increase the number of outstanding shares while proportionally lowering the individual share price. The primary purpose behind these splits is to make the Amazon stock price more affordable and accessible to individual investors, thereby increasing liquidity and potentially boosting the overall market valuation.

Additionally, a lower share price can psychologically appeal to potential investors, even though the total value of their holdings remains unchanged. Splits also play a role in employee compensation, making stock options more accessible and valuable, which can boost morale and attract talent. While stock splits primarily benefit from increased accessibility and liquidity, they have also played a role in maintaining broad ownership for the company during periods of rapid growth, indirectly impacting the Amazon stock price.

The Final Chapter (for Now): A Look Ahead at the Future of the Amazon Stock Price

From its modest beginnings at $4 per share, Amazon has evolved into a tech giant, leaving an indelible mark on the world. It has navigated economic storms, embraced innovation, and weathered controversies. While its future holds immense potential for both investors and tech enthusiasts alike, it's crucial to acknowledge the inherent uncertainty due to its ever-evolving strategies and the ever.

Please be informed that we do not confirm the accuracy of the aforementioned news as it pertains to market research. For ongoing updates and reliable information, we encourage you to follow us on Facebook, Twitter, and LinkedIn. Techtalkstoday consistently delivers the latest articles in this domain. Stay tuned for more updates.